We are a third party administrator of company sponsored retirement plans. We provide plan document services for new and existing plans. We work with your investment provider(s) and advisor(s) to increase plan participation and reconcile plan assets We prepare annual required government forms, and any ad hoc government filings. If your plan size requires an independent audit, we will work with your auditor to minimize your administrative burden.

We consult with our clients to help them determine the retirement plan design best suited for their individual and business needs. Rather than using a standardized approach, we offer flexible retirement plan documents which work for your employee population.

Our consultants are available year round to answer any questions regarding your plan’s government filings, nondiscrimination testing, fiduciary responsibilities, and compliance issues. We stay on top of the latest legislative requirements affecting your retirement plan so you don’t have to. We understand you have a business to run, and our goal is to minimize the administrative duties on your plate so you can focus on what you do best.

Specialization and Services

Our staff of highly qualified professionals provides consulting and compliance services for defined contribution plans, such as new comparability profit sharing plans, 401(k) plans (SIMPLE and traditional), 457 plans, and 403(B) Plans.

We also consult on money purchase pension plans, target benefit plans, traditional defined benefit plans and cash balance plans. Whether you are starting a new retirement plan, transferring administration of an existing plan, or looking for an unbiased consultation on your existing plan design, we are here to help.

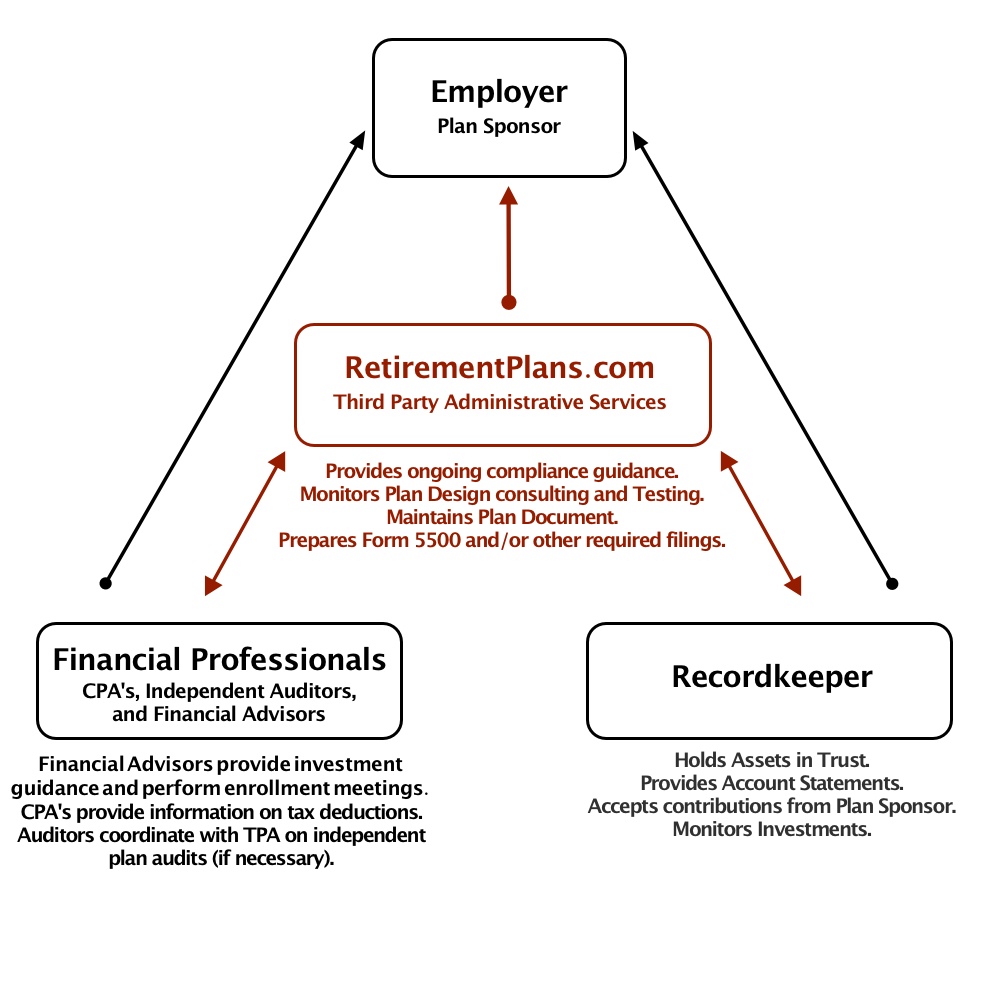

HOW A PLAN WORKS

The below image helps explain the the parties involved in plan inception and management and the interaction between entities.